Acuity Brands, Inc. (NYSE:AYI)‘s stock had its “underperform” rating reissued by JMP Securities in a research report issued to clients and investors on Thursday, April 6th. They presently have a $155.00 target price on the electronics maker’s stock, down from their prior target price of $185.00. JMP Securities’ target price points to a potential downside of 13.80% from the stock’s previous close.

A number of other analysts have also recently weighed in on AYI. Oppenheimer Holdings Inc. restated an “outperform” rating and issued a $265.00 price target (down from $295.00) on shares of Acuity Brands in a research note on Wednesday, January 11th. Wells Fargo & Co reiterated an “outperform” rating on shares of Acuity Brands in a research report on Wednesday, January 11th. Robert W. Baird cut their target price on Acuity Brands from $242.00 to $200.00 and set an “outperform” rating on the stock in a research report on Thursday, April 6th.

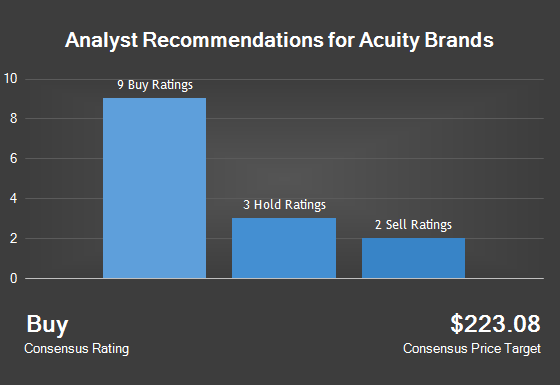

Goldman Sachs Group Inc lowered Acuity Brands from a “buy” rating to a “neutral” rating and lowered their price target for the stock from $256.00 to $186.00 in a report on Wednesday, April 5th. Finally, Roth Capital lowered Acuity Brands from a “neutral” rating to a “sell” rating and set a $150.00 price target on the stock. in a report on Friday, January 27th. Three research analysts have rated the stock with a sell rating, three have assigned a hold rating and ten have given a buy rating to the company. The stock has an average rating of “Hold” and a consensus price target of $230.86.

The firm also recently declared a quarterly dividend, which was paid on Monday, May 1st. Investors of record on Monday, April 17th were given a dividend of $0.13 per share. The ex-dividend date of this dividend was Wednesday, April 12th. This represents a $0.52 dividend on an annualized basis and a yield of 0.29%. Acuity Brands’s dividend payout ratio (DPR) is 7.50%.

In related news, Director Ray M. Robinson sold 1,100 shares of the company’s stock in a transaction on Tuesday, February 7th. The shares were sold at an average price of $206.19, for a total transaction of $226,809.00.

Following the completion of the sale, the director now directly owns 1,307 shares of the company’s stock, valued at approximately $269,490.33. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. 1.40% of the stock is currently owned by corporate insiders.

A number of institutional investors have recently bought and sold shares of AYI. FMR LLC boosted its position in Acuity Brands by 20.6% in the fourth quarter. FMR LLC now owns 2,703,383 shares of the electronics maker’s stock worth $624,102,000 after buying an additional 461,571 shares during the last quarter. Congress Asset Management Co. MA bought a new stake in shares of Acuity Brands during the fourth quarter worth about $90,878,000. Thrivent Financial for Lutherans raised its stake in Acuity Brands by 25,047.2% in the fourth quarter.

Thrivent Financial for Lutherans now owns 357,090 shares of the electronics maker’s stock valued at $82,438,000 after buying an additional 355,670 shares during the period. Norges Bank acquired a new stake in Acuity Brands during the fourth quarter valued at $70,102,000. Finally, DZ BANK AG Deutsche Zentral Genossenschafts Bank Frankfurt am Main acquired a new stake in Acuity Brands during the fourth quarter valued at $61,140,000. 91.28% of the stock is owned by institutional investors.